Will The Fed Rise Rates By 2023?

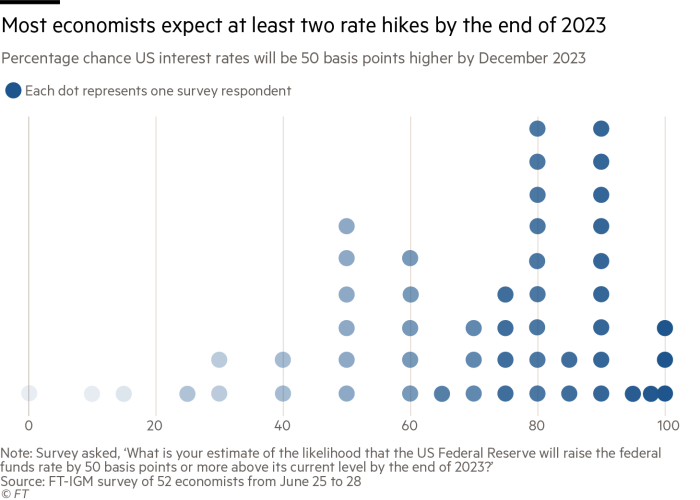

According to the Financial Times, the likelihood of rate hikes before the end of 2023 is now very high among economists. In a joint survey with the University of Chicago, 52 economists were polled on their views on whether they believed interest rates would be 50 basis points higher by the end of 2023, the results are shown below, in the form of a dot-plot, as used by the Fed.

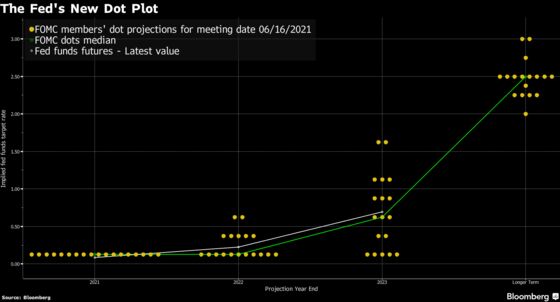

The results are striking and closely resemble the sentiment of the Federal Open Markets Committee (FOMC) in the recent dot-plot published by the Fed after the June policy meeting, which is shown below.

The views of the FOMC and that of academic economists being closely aligned means a scenario where interest rates are at least 50 basis points higher by the end of 2023 is now very likely to happen as a hawkish view is starting to take hold among both economists and the FOMC alike.

What will be the driving factor for rate hikes by the Fed?

In my opinion, the Fed is worried about the recent rising inflation, reaching 5% last month - the highest level since 2008. There is likely a lot of worry in the FOMC that as the economy starts to unlock further, and as the pent-up demand is used up, that we could see even higher levels of inflation over the next year due to demand-pull. To combat the demand-pull inflation the only real choice the FOMC have is to rise interest rates, making borrowing more expensive and forcing people to spend less.

What will the effect of higher interest rates have on the market?

There will be no immediate effect on the market after an increase in interest rates as the market has already priced this in. However, over the longer term, the increase will have an adverse effect on the performance of the market. As consumers are spending less due to the higher cost of borrowing, firms are generating less revenue and hence less profit. The reason this will have an adverse impact on firms' share price is due to the simple calculation of a firms' share price: the sum of the future discounted cash flow divided by the number of shares available on the market. As firms are generating less revenue, their expected cash flows will be lower while their shares available will remain unchanged. This will lead to a lower share price on the market.

Closing thoughts?

While there will be no immediate impact on the stock market after a rate hike, over the next few years we are likely to see some downward pressure on shares and a more bearish attitude by investors in the market as we come closer to 2023. However, if the market is kept well informed of the FOMC's intentions around rates, then you do not need to start preparing for the apocalypse, but just remember to buckle in for a bit more of a bumpy ride in 2023.

Comments

Post a Comment